K2 Economics

May 23, 2018

The U.S. Supreme Court ruled that arbitration agreements requiring that an employer and an employee resolve any employment disputes through one-on-one arbitration do not violate the National Labor Relations Act (NLRA). In an opinion authored by Justice Neil Gorsuch, the Court ruled 5-to-4 that the Federal Arbitration Act (FAA) dictates that arbitration agreements be enforced, […]

K2 Economics

February 29, 2016

Tax ruling confirms protocol on job-related judgments The California Court of Appeal recently confirmed that employment-related settlements or judgments are wages from which employers must withhold payroll taxes. In Cifuentes v. Costco Wholesale Corp., Cifuentes challenged former employer Costco’s withholding of payroll taxes from a wrongful termination judgment. The court ruled in favor of Costco, […]

K2 Economics

January 13, 2016

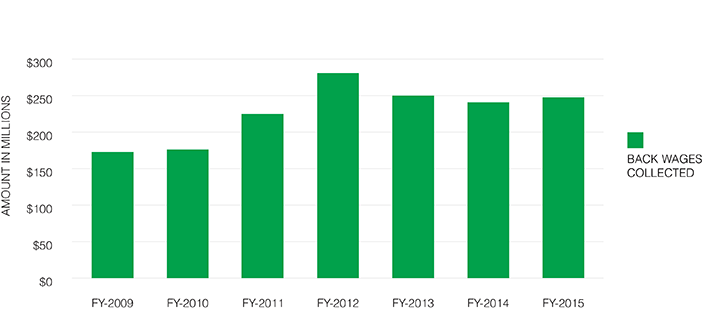

According the US Department of Labor – Wage and Hour Division, in FY 2015, over $246 million in back wages for over 240,000 workers was collected. View full statistics here: https://www.dol.gov/whd/statistics/statstables.htm With the number of Wage & Hour claims increasing, hirings an expert economist to calculate the damages can be a great asset to have in court.